I still remember the days when iPhone releases sparked a frenzy, with long lines of eager customers camping outside stores for days, all hoping to be among the first to hold the latest model. The media would buzz over the first lucky buyer, capturing the excitement of the early rush. But fast-forward to the iPhone 16 launch, and that once-unstoppable hype seems to have quieted down, particularly in Asian markets, where the release feels more like a calm, steady rollout rather than the spectacle it used to be.

iPhone’s Financial Commitment and User Hesitation

According to the iPhone Index, the iPhone is positioned as a high-tier smartphone in the Asian market, making its promotion vital for telcos aiming to restructure their customer base toward higher ARPU segments. The “iPhone Index,” similar to the Big Mac Index, highlights how many workdays it takes to afford an iPhone across different countries. In Asia, consumers often need up to 60+ days of wages to buy the latest model. That’s a significant financial commitment, and when you factor in that a portion of their annual salary goes to this purchase, it requires serious consideration and loyalty.

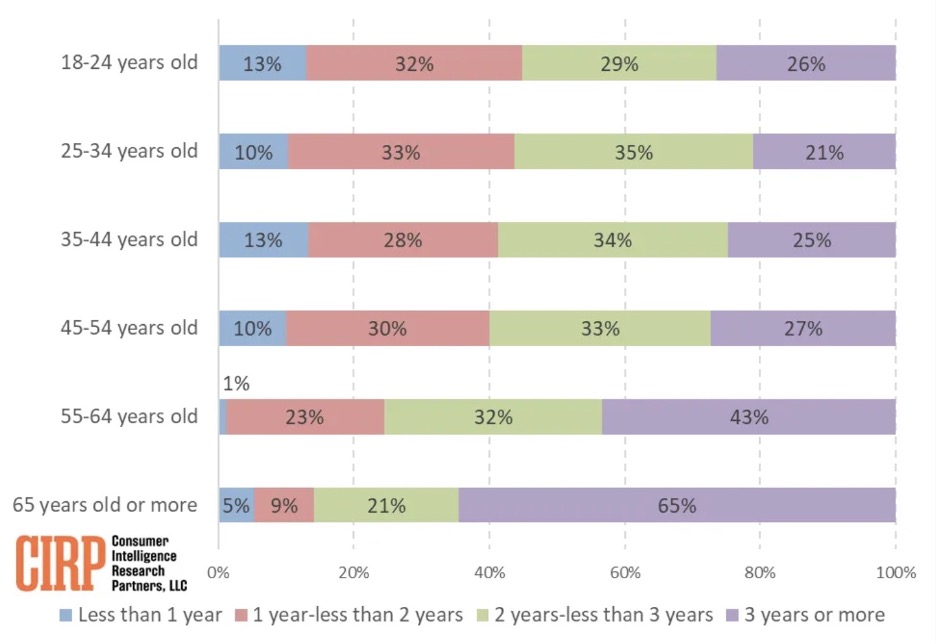

The iPhone upgrade cycle has stretched from 3 years to nearly 4 years, according to a 2019 iPhone analyst report. By age group, it shows a different pattern: younger users (18-44) tend to upgrade more frequently, often within 1-2 years, while older users (55+) are holding onto their phones for 3+ years. This behavior might also be influenced by the utilization of trade-in offers, as younger generations seem more willing to adopt these promotions to manage the cost of upgrading. Especially with the latest older models getting the maximum trade-in values, younger users can leverage these deals for faster upgrades, making the financial commitment more manageable.

In South Korea, media reports indicate that iPhone sales are heavily driven by younger consumers, with those in their twenties making up around 35% of the total purchase group. SK Telecom revealed that 65% of reservations were for the iPhone 16 Pro model, followed by the Pro Max, standard iPhone 16, and iPhone 16 Plus. Meanwhile, in Hong Kong, the usual street scenes of resellers flipping iPhones to those who missed pre-orders may be quieter this time, as Apple’s price reduction plan for the iPhone 16 has likely cut into resellers’ margins.

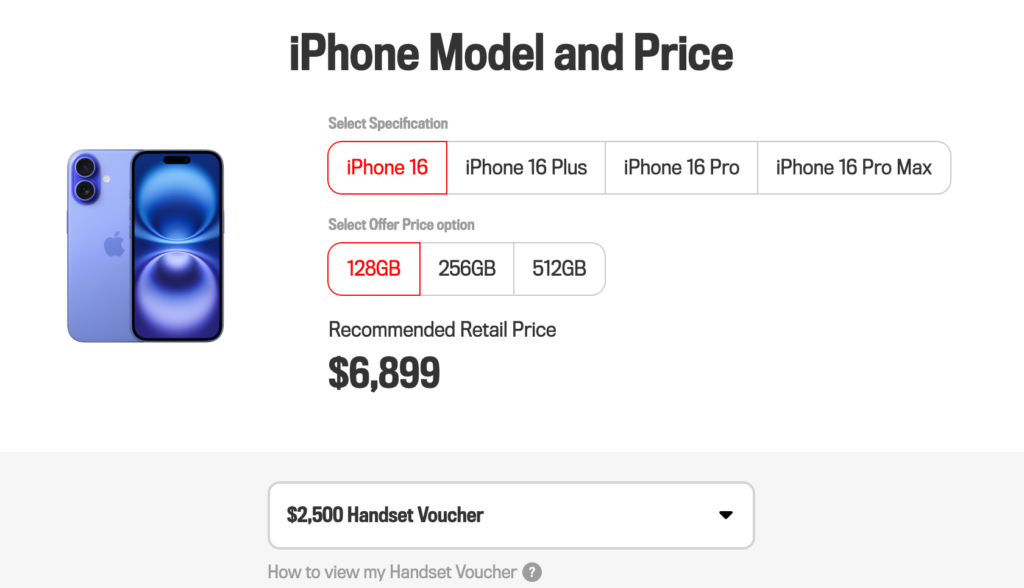

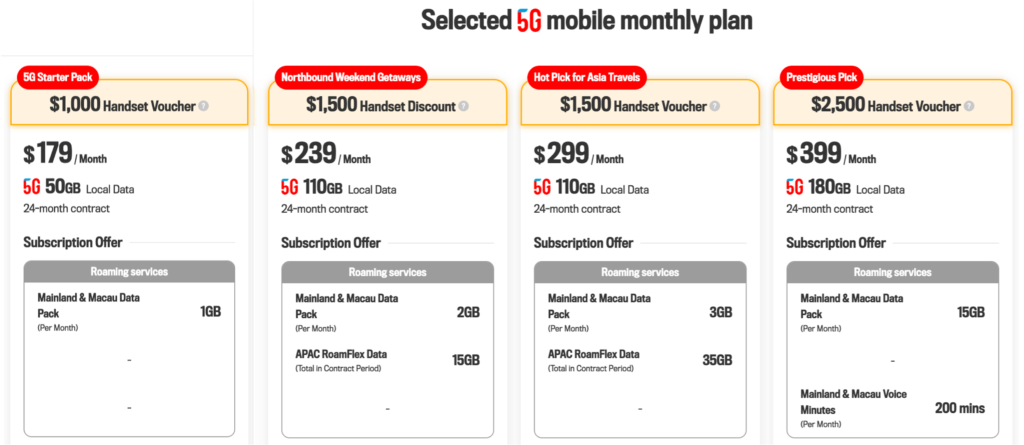

Looking at the iPhone 16 promotion pages from telecom operators, there’s a noticeable lack of compelling offers aimed at attracting high-tier mobile users. Only SmarTone showed a bit of initiative by offering a differentiated subsidy of up to HKD 2,500 for users selecting a high-tier 5G plan. In contrast, CSL and Three did not offer such incentives. South Korean telcos, like KT, still provide tiered subsidies, but the gap between plans is not enough to upsell users to higher 5G tiers. Telcos now face the challenge of building their loyal fan base beyond iPhone-driven promotions.

However, this loyal iPhone fan base remains a critical group for telcos to maintain and entice, especially since the faster upgrade cycle is largely driven by the younger generation. How telcos design iPhone packages that go beyond just 5G data plans will be key. Offering additional perks, such as attractive media or entertainment benefits, could help telcos capture these young value-driven consumers and strengthen their appeal to this important demographic.