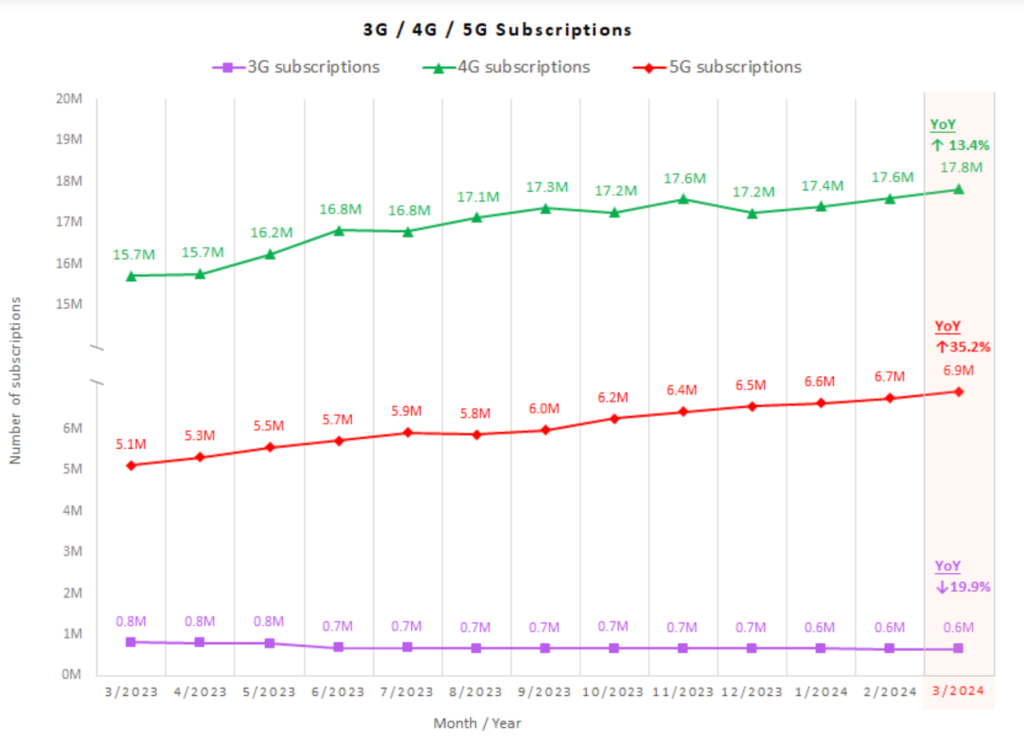

As 5G enters its sixth commercial year, industry predictions from GSMA suggest that over 50% of connections will be 5G by 2029. However, in a surprising twist, Hong Kong’s mobile market has seen a rebound in 4G subscribers. OFCA data actually showed a bigger increase in 4G subscriptions than 5G from 15.7 Mil to 17.8 Mil even in 2023, despite the negative impacts of real-name registration for SIM purchase. This shift underscores the power of effective market segmentation and reveals that well-targeted marketing can keep older technologies relevant and even thriving. This case stands out as one of the most interesting telecom marketing strategies, demonstrating how market dynamics can be influenced through strategic initiatives.

I still remember 2020, a busy year for Hong Kong mobile operators as they introduced the concept of 5G to the mass market for the first time. Hutchison HK was among these operators, but they also launched a prepaid sub-brand called SoSIM in the local market that year, in partnership with Parknshop, one of the biggest supermarket chains in Hong Kong, using it as an offline channel for SIM card distribution. In recent 2 years, SoSIM has acquired more than one million subscribers and this fast user acquisition significantly shifted total user structure from being postpaid-biased to more prepaid users. This shift towards a prepaid-heavy user base, in terms of business value point of view, presents challenges for telecom operators due to the typically lower ARPU (Average Revenue Per User) associated with prepaid plans.

cf. from Y2023 financial report, Three reported prepaid ARPU as 14 HKD, postpaid as 190 HKD.

Let’s understand the rationale behind Hutchison’s decision to promote the low-cost prepaid market. To get their point, we need to see who owns Hutchison HK: Li Ka-shing, one of the most influential business magnates in Hong Kong, who also owns the biggest retail chain in the HK market. When the COVID-19 pandemic changed HK consumer behavior, shifting from offline to online shopping, Li Ka-shing’s retail chain faced sluggish growth in their offline visitors. Therefore, the partnership between SoSIM and Parknshop was strategic. The increased foot traffic in Parknshop stores, driven by customers seeking SoSIM cards, likely contributed to a boost in conversion rates and average transaction values. This collaboration not only provided convenient SIM card distribution points for SoSIM but also helped Parknshop leverage the influx of visitors to drive additional sales. The synergy between SoSIM’s marketing strategy and Parknshop’s retail environment demonstrates how effective partnerships can enhance customer reach and operational efficiency.

From the beginning, SoSIM’s value proposition was to serve as a supplementary SIM. As long as they can drive synergy between their offline retail chain and outdated 4G network, it seems fine with customers of repurchasing new SIM each month. For SoSIM, retention of these SIM cards might not be their primary KPI. Instead, they focus on creating additional value for their offline channels. They offer rewards like toothpaste and shampoo from Watsons and Parknshop for each SoSIM recharge, encouraging frequent visits to their retail stores. This approach not only incentivizes continued use of SoSIM but also boosts foot traffic and sales in their retail outlets. It would be fascinating to conduct an RFM (Recency, Frequency, Monetary) analysis targeting prepaid SoSIM users to understand how this segment impacts cross-sales in their retail chains. This analysis could provide deeper insights into customer behavior and the effectiveness of their integrated marketing strategy.

For me, this Hutchison case offers significant learning points. In the past, telecom operators simply needed to be the first to introduce new technology. Now, they have to serve different small mass markets and become experts in segmentation. I will continue to share telecom marketing lessons for my audience, as this evolving landscape provides valuable insights into how to adapt and thrive in a competitive market.

However, from the perspective of a technology company, this move is less favorable for traditional telecom operators. They worked hard to boost 4G services when they really need to migrate their user base to high-value 5G subscriptions. Currently, many 5G telecom operators face challenges as majority users do not see the necessity for 5G when their usage, like watching merely TikTok or YouTube on mobile, is met by 4G. On the other hand, even in advanced 5G benchmark countries like South Korea, operators face challenges in just retaining users who opt for low-cost MVNO operators. In this context, if Hutchison hadn’t moved forward with SoSIM, other supermarket chains might have taken a similar approach as MVNOs to leverage their offline retail chains. For instance, Tesco in the UK has already acquired 6 million subscribers through similar strategies. This trend underscores the need for telecom operators to innovate and find new ways to demonstrate the value of 5G to their customers.