Since entering the consumer market in 2016, eSIM(embedded SIM) technology largely lingered in the background until it captured the spotlight in September 2021 with Apple’s launch of its first eSIM-only iPhone. This pivotal moment marked a significant shift in mobile connectivity, as users began embracing the convenience of switching telecom services with just a simple download of an eSIM profile. Beyond the ease of service changes, eSIM technology unlocks expansive possibilities for multiple device connectivity—from smartphones to IoT devices like smartwatches and automotives, etc. However, this shift presents a dual-edged sword for telecom operators; while eSIMs enhance user flexibility and device integration, they also disrupt traditional churn management strategies, posing both opportunities and challenges within the industry.

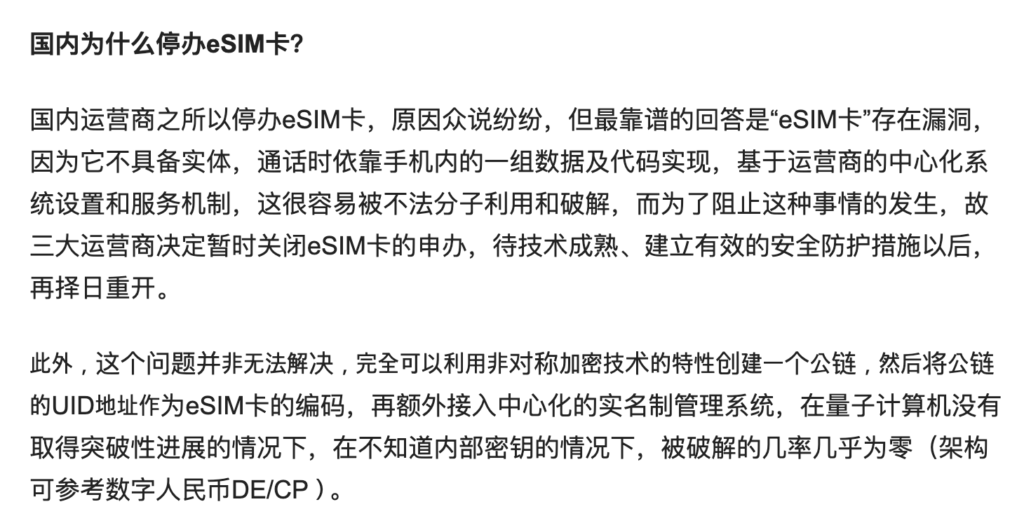

Global adoption status of eSIM technology varies significantly, shaped by distinct government policies and market readiness. The United States and Canada lead in eSIM services, leveraging this technology extensively across a broad spectrum of devices. In contrast, Europe has embraced eSIMs across nearly all its nations, setting a robust standard for connectivity. However, Africa trails behind, with adoption hampered by market conditions and technology penetration rates. Yet, the landscape is poised for change as more affordable eSIM-enabled phones begin to enter the market, promising broader accessibility. Chinese mobile phone market remains untouched by formal eSIM adoption. Despite keen interest from smartphone manufacturers and growing support from operators in the wearables sector, no official move has been made to introduce eSIMs in Chinese handsets. This scenario underscores the complex interplay between technological advancements, regulatory environments, and market dynamics, each shaping the pace and pattern of eSIM adoption globally.

[Figure 2] Why has eSIM card been stopped in China?

“There are many reasons why domestic operators stopped issuing eSIM cards, but the most reliable answer is that the “eSIM card” has loopholes because it does not have an entity and relies on a set of data and code in the phone to implement calls. Based on the operator’s Centralized system settings and service mechanisms can easily be exploited and cracked by criminals. In order to prevent this from happening, the three major operators have decided to temporarily close the application for eSIM cards until the technology matures and effective security protection measures are established. Later, we will choose a date to reopen.”

Translation of Figure 2 [Why has eSIM card been stopped in China?]

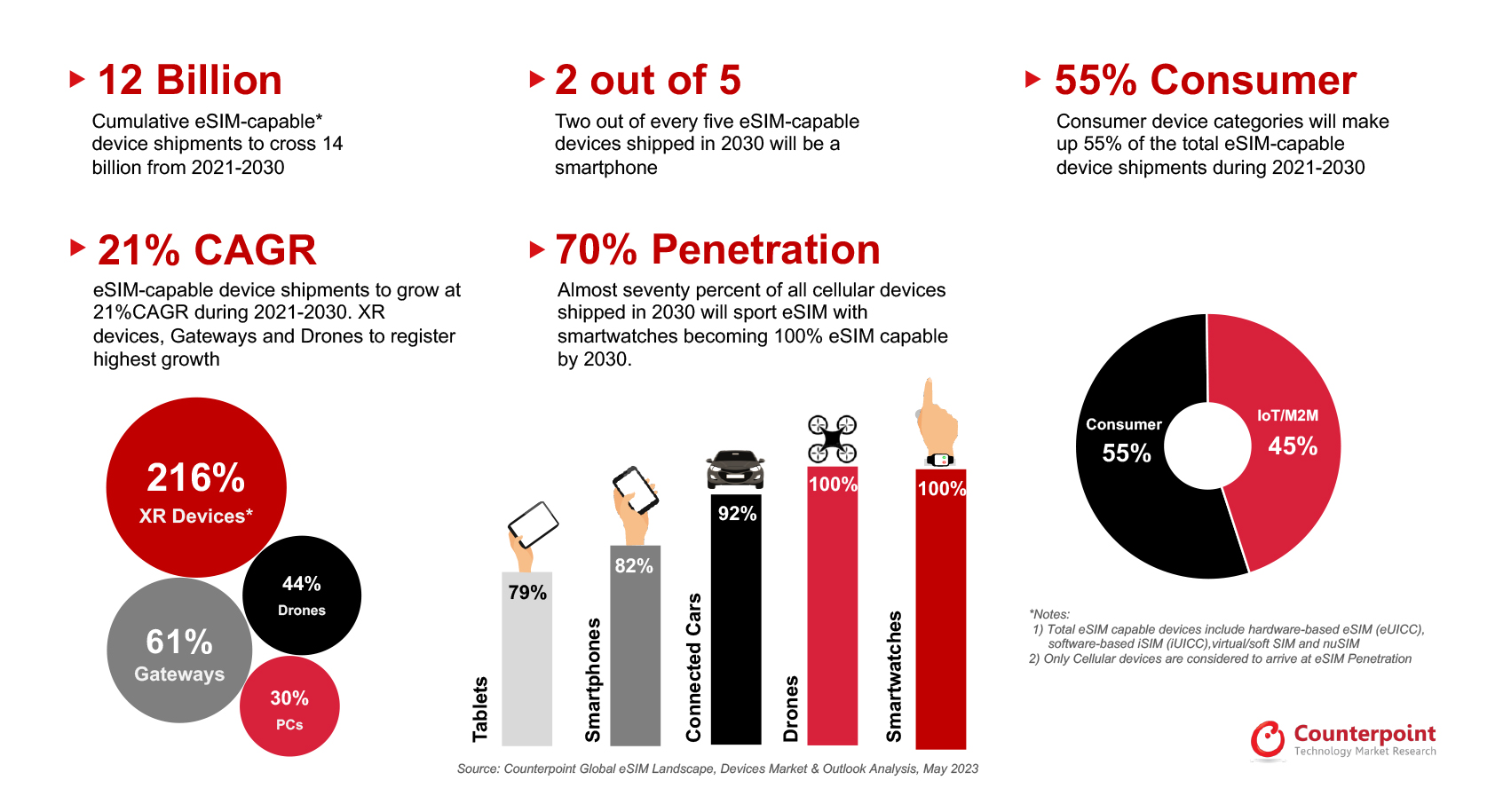

eSIM is expected to support 70% of all cellular devices by 2030; 100% in smartwatches and drones, 92% in connected cars, 82% in smartphones, and 79% in tablets. According to a GSMA report, The number of eSIM connections will have grown by 458% between 2021 and 2030, and 55% of eSIM devices shipped will be aimed at consumers. Therefore, various use cases mostly cover mobile network operators and in travel applications. Nevertheless, Mobile Virtual Network Operators (MVNOs) must also engage and exploit opportunities through digital sales channels enabled by eSIM. Furthermore, AI solution providers need to adjust to capture the evolving dynamics in predictive analytics, highlighting the changing telecommunications landscape.

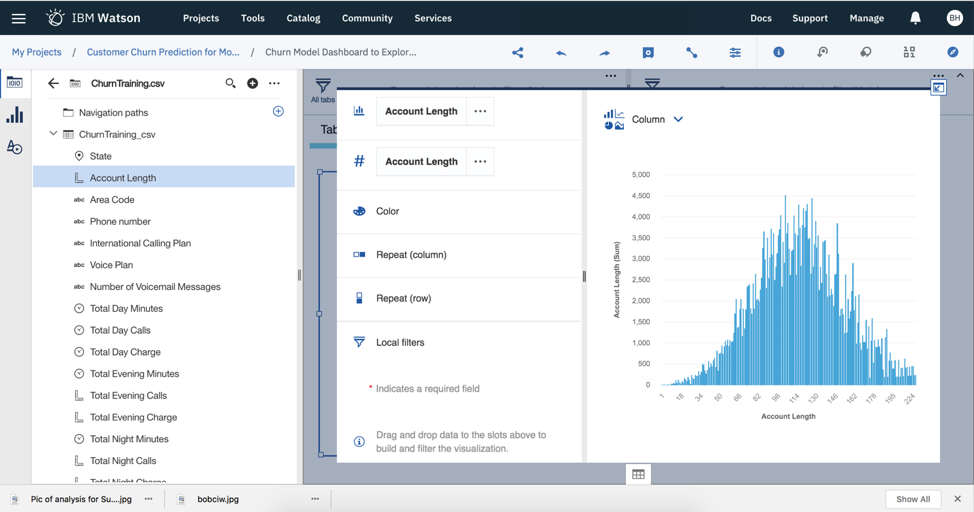

Currently, many AI analytic solutions tailored for telecom companies distinguish between postpaid and prepaid scenarios. In prepaid models, churn prediction primarily focuses on top-up behaviors, whereas in postpaid, the emphasis shifts towards assessing customer lifetime value and contract duration. However, the advent of eSIM technology complicates these dynamics. It facilitates a seamless switch of services for prepaid users, and postpaid customers might consider adding a second SIM in their eSIM slot. Consequently, predicting user value as a master SIM user becomes increasingly critical, transcending the traditional focus on merely forecasting port-out cases. This shift underscores the need for analytics that adapt to the evolving landscape where eSIM enables greater flexibility and changes in user behavior.