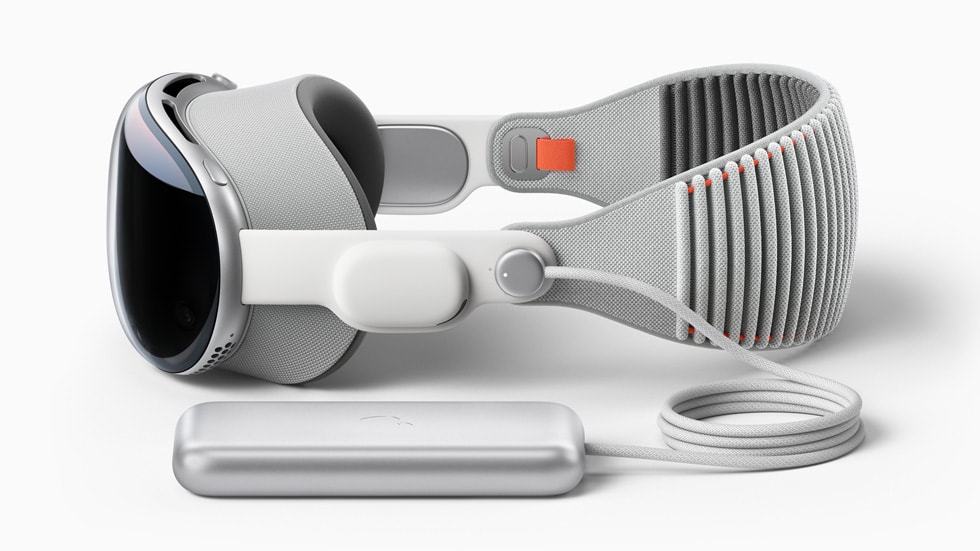

On June 5, 2023, Apple unveiled its latest innovation, the Apple Vision Pro, a mixed-reality headset designed to blend the virtual and real worlds seamlessly. Despite its high-end features and capabilities, the Apple Vision Pro, with a steep price tag of $3,500, positions itself within a niche market. Initial reports suggest that Apple has managed to sell around 200,000 units of the Vision Pro, indicating a burgeoning interest despite the premium pricing. This launch not only highlights Apple’s foray into mixed reality but also underscores the exclusivity of the device due to its cost, making it a luxury beyond the reach of the average consumer.

As telecom industry insiders, we’ve been anticipating the excitement surrounding MR devices like the Apple Vision Pro since the advent of 5G services five years ago. The transition from 4G to 5G was marked by significant improvements in speed and latency, promising to revolutionize services like AR, VR, and cloud gaming. However, the nature of VR, which requires fixed location usage due to its immersive design that blocks the user’s sight, presents a conflict with the mobile and on-the-go premise of 5G. As a result, AR and VR technologies, while initially touted as key features to showcase the capabilities of 5G, have not become central to the 5G consumer experience, remaining more as intriguing showcases rather than integral, everyday applications.

The Apple Vision Pro, while a significant leap in mixed reality technology, faces practical challenges for everyday use. Its high cost, combined with the physical discomfort of wearing a device weighing over 600 grams on your head, makes it less accessible for daily basis. This situation underscores a broader challenge in the tech industry: the quest for the next innovation on par with the smartphone revolution is still ongoing. Moreover, the successful introduction of new services often hinges on the availability of new, user-friendly devices. In the early days of 5G, telecom companies launched various so-called 5G killer services, yet many have not sustained or validated a clear business model. Notably, LG Uplus, a leading telecom operator, ended its cloud gaming partnership in 2023, and its competitor KT also concluded their game platform service. These developments highlight the intricate dance between technological advancement and practical utility in the consumer market.

The series of setbacks telecom companies have faced in rolling out 5G-centric services highlight a crucial learning point: the need for telecom operators to redefine their roles within the broader digital ecosystem. Rather than working in isolation, there’s a growing recognition of the importance of forming strategic partnerships. Collaborating with technology providers, content creators, and industry-specific enterprises can lead to the development of innovative use cases that more effectively leverage 5G’s capabilities. This collaborative approach can help telecom companies move beyond traditional connectivity roles, allowing them to play a more integral part in the value chain by co-creating services that resonate more deeply with consumer needs and industry demands.