In the telecom world, AI isn’t new. Services like voice-controlled home devices have been around for a while. But when it comes to voice assistants, big names like Alexa, Google, and Siri lead the way, leaving telecom voice services behind. Now, with chatbots becoming more common, it’s even tougher for telecom companies to stand out in the AI field. This situation raises questions about how telecoms can make their mark in the world of AI.

This pattern isn’t new. We saw something similar with the launch of smartphones, especially the iPhone, which shifted control of the digital ecosystem away from telecom companies. Despite attempts to reclaim influence by branding services as “smart” – like smart homes, smart stores, and smart money – telecoms couldn’t regain their central role in the mobile world. Now, with AI emerging as a new frontier, telecom companies are at another turning point, facing the challenge of how to stay relevant in this rapidly advancing field.

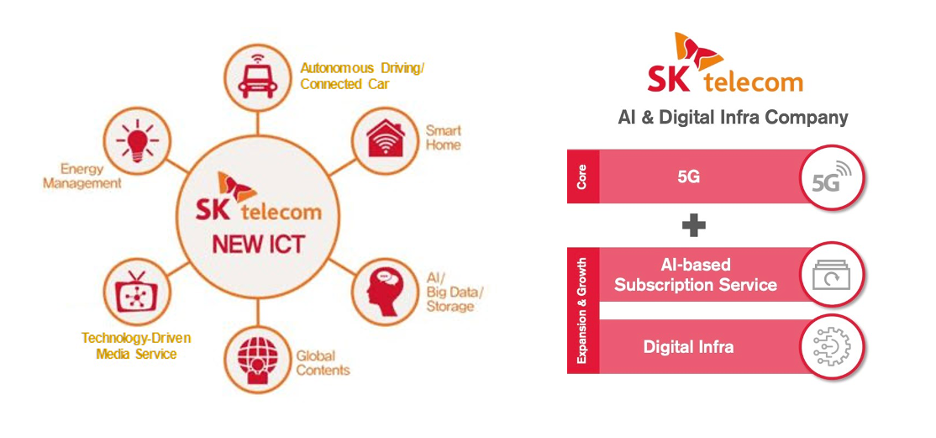

SKT’s journey in the AI race is filled with trials and errors, highlighting the challenges in the telecom industry’s shift towards either smart and AI service. Since 2017, SKT’s CEO, Park Jung-ho, has been pushing the company to evolve from a traditional telecom provider into a broader ICT company, emphasizing the importance of integrating AI and cloud technologies across new sectors, despite potential short-term losses. This ambitious shift has led to various experiments, like the Nugu AI service, which had difficulty in expanding its value chain due to its limited popularity. SKT’s experience underscores the complex path telecom companies face in adapting to and embracing AI-driven transformations.

Despite facing setbacks in the consumer AI market, SKT hasn’t given up on its ambitions, with services like Adot still in play. Yet, these offerings often lack standout features, with call summary services being one of the few exceptions. This scenario isn’t unique to SKT; many telecom companies might find themselves in a similar position, overshadowed by larger chatbot providers dominating the market. This reality suggests a strategic pivot might be necessary. Instead of competing in a crowded B2C space, telecoms could find more success and relevance in the B2B sector, focusing on delivering customized SaaS ›AI solutions tailored to specific needs in the domestic market. This shift could represent a more viable and impactful path for telecom companies looking to leverage their strengths in the age of AI.