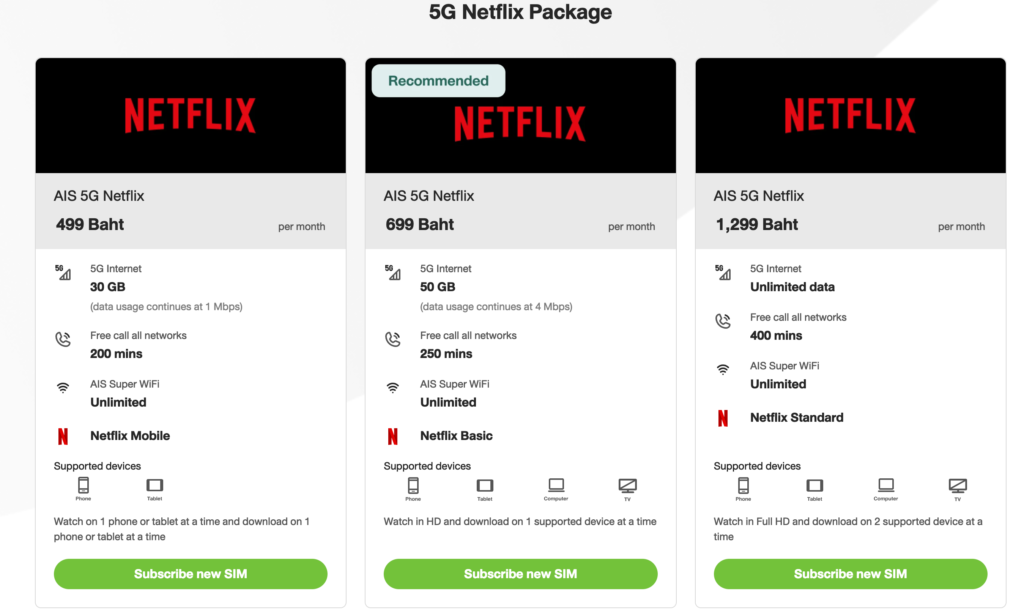

The landscape of OTT SVOD industry is characterized by fierce competition, where streaming services strive to forge alliances to expand their subscriber base and achieve global reach. At the forefront of this battleground stands Netflix, an industry leader renowned for its strategic partnerships for global market expansion. From Europe to Asia, it’s becoming increasingly easy to find telecom operators offering Netflix-bundled packages in their mobile tariffs, promoted as a unique benefits of their services. As an example, Thailand’s AIS divides its postpaid tiers, offering Netflix memberships along with varying amounts of GB.

In September 2017, T-Mobile first rolled out its Netflix bundle as a part of their Un-carrier strategy, providing free Netflix subscriptions with selected mobile plans. This strategic move not only enhanced mobile data usage among customers but also played a key role in attracting new users, thereby solidifying T-Mobile’s position in the market.

However, with the rise of new OTT services like Disney+ and Amazon Prime, customers now have a wider selection of OTT streaming apps. As a response, telecom operators are increasingly offering streaming app bundles as value-added services. One notable example is Optus Subhub, which acts as an aggregator, providing customers with a diverse range of OTT subscriptions as part of their telecom packages.

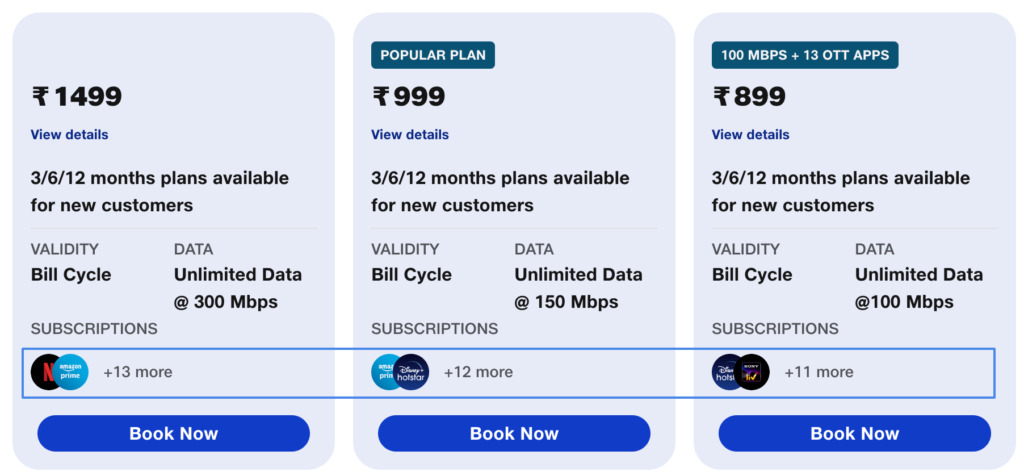

Jio in India has enhanced its fiber and airfiber plans by including a diverse selection of OTT services, adding more value to their higher-tier offerings. These premium plans not only provide faster broadband speeds but also grant access to a varying array of OTT streaming services. Taking a step further, Jio has forged a partnership with OTTplay Premium, an AI-powered OTT subscription and recommendation platform, to deliver a more tailored and user-friendly streaming experience. This collaboration enables Jio set-top box users to seamlessly access and enjoy content from 19 popular OTTs, including Sony Liv, Zee5, Lionsgate, FanCode, among others, all through the convenient interface of the OTTplay app.

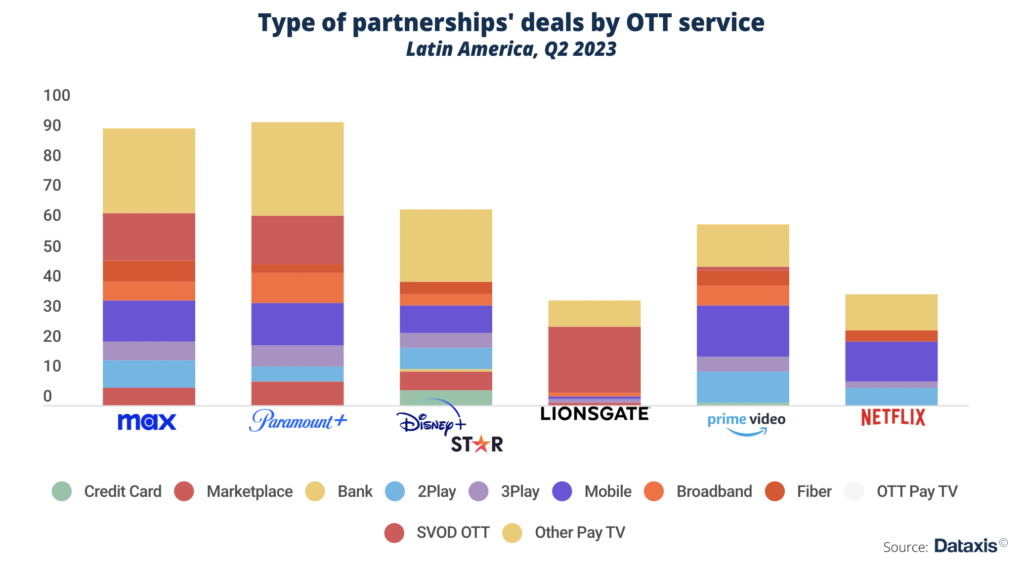

As we navigate this dynamic landscape, we can observe incremental shifts taking place. According to a recent Dataxis report, the industry has been witnessing a gradual transformation. In Latin America, Paramount+ and Max have embarked on a proactive journey, entering into multiple distribution agreements and expanding their horizons, actively targeting various industry partners. This strategic evolution appears to be an effort to narrow the gap with the industry giant, Netflix, renowned for its extensive network of partnerships with top-tier mobile, broadband and Pay TV operators.

OTT players are constantly exploring new pathways to expand their user base, with telecom operators playing a crucial role in this ecosystem. However, to avoid being relegated to mere billing aggregators, telcos must focus on enhancing user interfaces and catering to key segments. The future of OTT and telecom collaboration hinges on their ability to adapt and offer more than just connectivity, shaping a more integrated digital entertainment experience.