In the rapidly evolving landscape of digital transformation, the introduction of smart home services has emerged as a pivotal yet challenging for operators to continue showcasing their vision. This narrative was recently underscored by several big Telco’s decision to discontinue its smart home service, a move that highlights the complexities faced in this sector. In 2023, Swisscom’s retreat from the smart home arena, driven by a shortfall in market attention, not only reflects the intricate dynamics telecom operators encounter but also marks a significant shift in the industry’s approach to smart home integration.

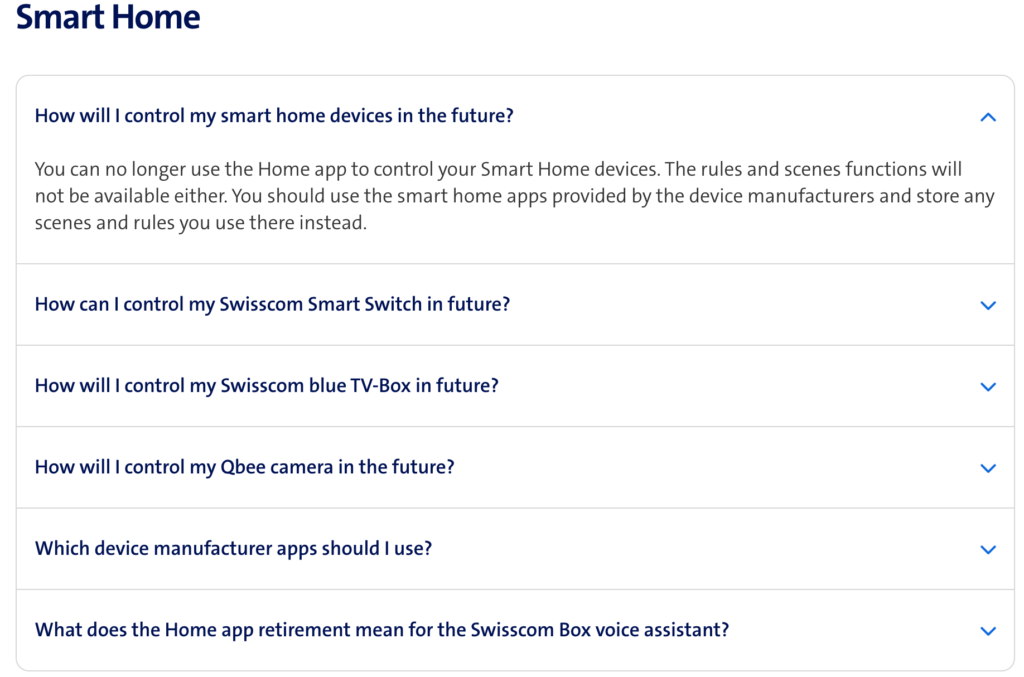

Telecom operators have traditionally aimed to establish unified control points across a range of home devices, with a vision centered on facilitating integrated smart home use scenarios. However, with Swisscom’s recent withdrawal from the smart home market, users now find themselves returning to the individual smart home apps provided by each manufacturer

SK Telecom ventured into the market with an add-on service specifically targeting the senior segment. This initiative, while innovative, faced its own set of challenges, leading the company to eventually offer the service for free, citing a lack of active users as a primary reason. The advent of advanced AI chat services, accessible to a broad audience, has potentially diluted the uniqueness of telecom-provided AI solutions. The challenge for telecom operators to differentiate their offerings in a market rapidly being reshaped by versatile and widely available AI technologies.

In another significant development, Orange announced its decision to discontinue its smart home service in France, along with the associated iOS and Android apps. This strategic move came in the wake of acknowledging a ‘very weak market’ for services related to connected objects. It reflects a market reality where consumer demand and the viability of connected home services have not aligned with the expectations and investments of telecom companies.

Adding to the pattern of retreats in the telecom sector’s smart home market, Telstra, a major Australian operator, made a similar move in December 2020.

The company charged a significant $30 per month for control and monitor kit with a lengthy 24-month contract, or alternatively, an upfront fee for the device. Notably, this pricing did not include network fees – a crucial factor one might expect to be a selling point for a telecom-operated smart home service. Additionally, a substantial setup fee of $720 was required, along with early cancellation charges, further increasing the financial commitment for users. This model, heavily reliant on traditional subscription and upfront payment structures, reflects a broader tendency in the telecom industry to stick with familiar business models. However, without offering truly innovative or differentiated services, such strategies may struggle in a market where consumers are increasingly looking for flexibility, affordability, and value-added propositions