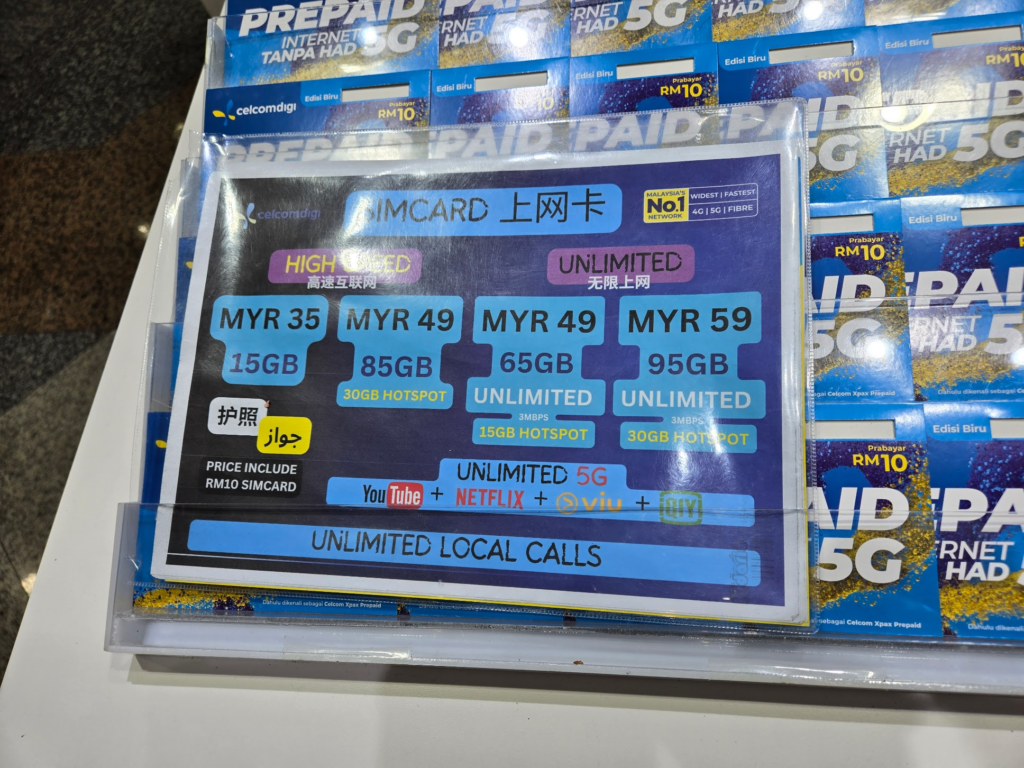

In the summer of 2024, I found myself at Kuala Lumpur International Airport, where several telecom operators were actively targeting travelers with their 5G SIM card offerings. Among them, I opted for a SIM from CelcomDigi. Interestingly, Malaysia’s 5G network operates under a unique government-led infrastructure-sharing initiative, creating the impression that 5G network service across providers would be fairly uniform. Yet, the reality was a little bit different. Even at the airport, there was a notable price difference in 5G pricing between telcos, with CelcomDigi being on the pricier end. As I moved to the city center, I noticed that 5G coverage varied significantly by location—often dropping back to 4G despite the promise of comprehensive 5G availability. This experience highlighted not just the disparity in costs but also the nuanced challenges of consistent coverage from shared 5G environment.

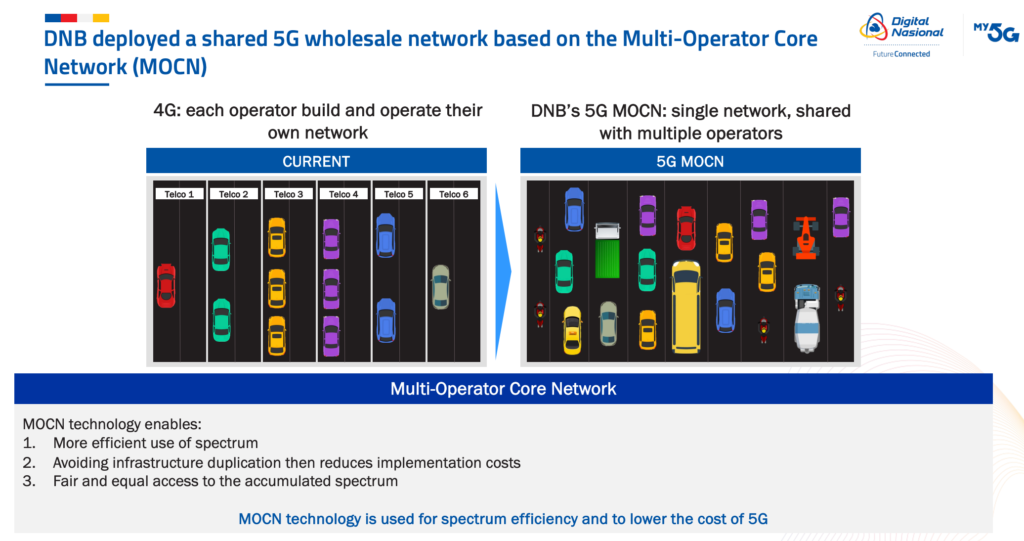

In 2024, the Malaysian government, through Digital Nasional Berhad (DNB), introduced a single wholesale 5G network model. This approach was adopted to hasten the rollout of 5G for all operators, emphasizing efficient resource use and cost reduction for both telecom companies and consumers. Below diagram illustrates how this new wholesale model compares with traditional telecom network operations, highlighting the key differences and intended efficiencies. Why has the telecom industry embraced such a business model? Does this reflect concerns that 5G might not generate sufficient revenue streams for telecom operators in Malaysia?

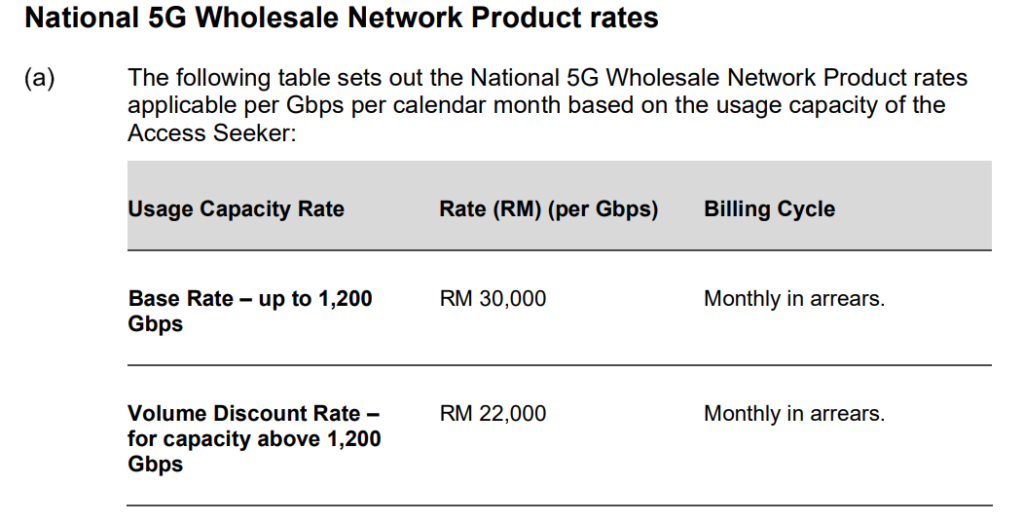

According to the Digital Nasional Berhad (DNB) pricing reference, operators are charged based on capacity. The base rate for up to 1,200 Gbps is RM 30,000 per Gbps monthly, with a volume discount rate for capacities above 1,200 Gbps at RM 22,000 per Gbps monthly. This capacity-based pricing model facilitates pricing differentiation based on the network capacity purchased, potentially ensuring better speeds. However, as users transition from their own 4G networks to the shared 5G infrastructure, operators may experience a loss of control in network quality optimization and customer experience management, effectively becoming more like virtual operators. This shift to a predominantly OPEX-heavy business model, where they must pay a 5G service fee to DNB,

These operational unclear risks could be the reasons why operators like Celcomdigi and Maxis highlight “4G & 5G service” rather than exclusively “5G”. These mobile carriers might still aim to retain users on 4G where they can maintain more control under hybrid 4G&5G postpaid. This is going to be very interesting business scenes in 5G and Asia market. I’ll continue to follow-up how Malaysia operators strive to differentiate their services and avoid becoming mere conduits