In the US broadband market, the last year has marked a notable shift towards Fixed Wireless Access (FWA), with T-Mobile spearheading this movement. By Q3 2023, T-Mobile had successfully expanded its FWA customer base to 4.2 million, outpacing Verizon’s 2.7 million, and signaling a growing appetite for alternative broadband solutions. Interestingly, current FWA offer isn’t rooted in superior speed quality comparable to traditional fixed broadband. Instead, operators like T-Mobile and Verizon have carved a niche for FWA by focusing on its affordability and flexibility. These attributes resonate strongly with a segment of end-users who prioritize cost-effectiveness and ease of setup over the high-speed benchmarks set by wired connections. This trend underscores changing user trends in broadband services, where the value proposition is increasingly defined by customer-centric solutions tailored to diverse needs and preferences, rather than sheer speed performance alone.”

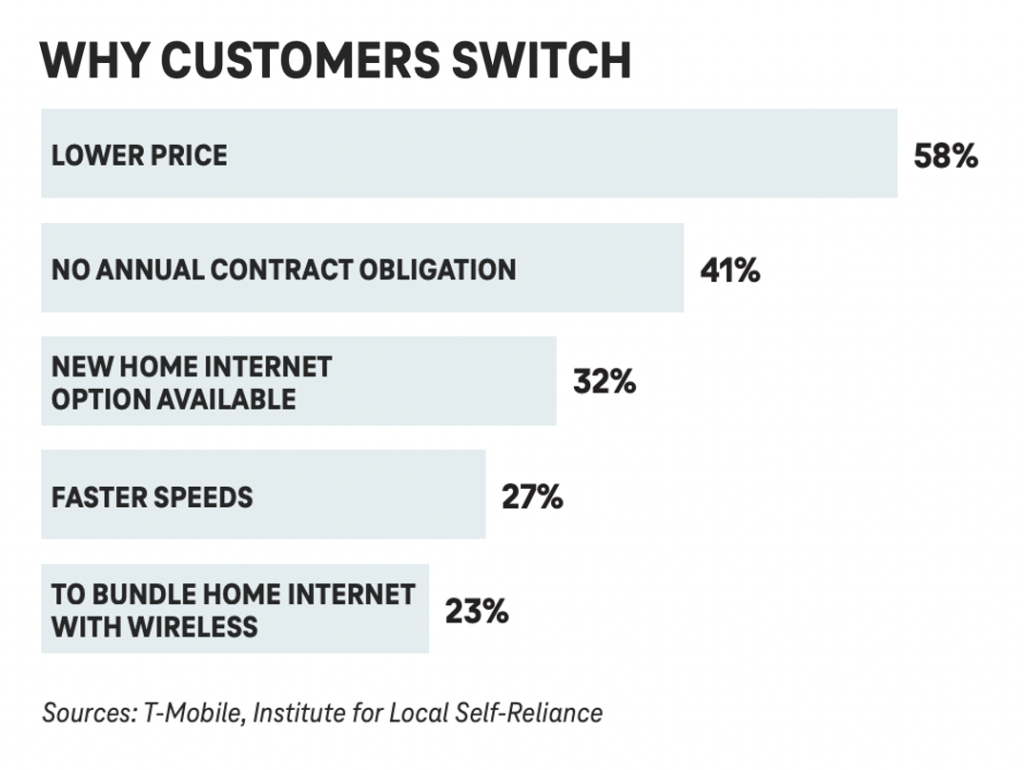

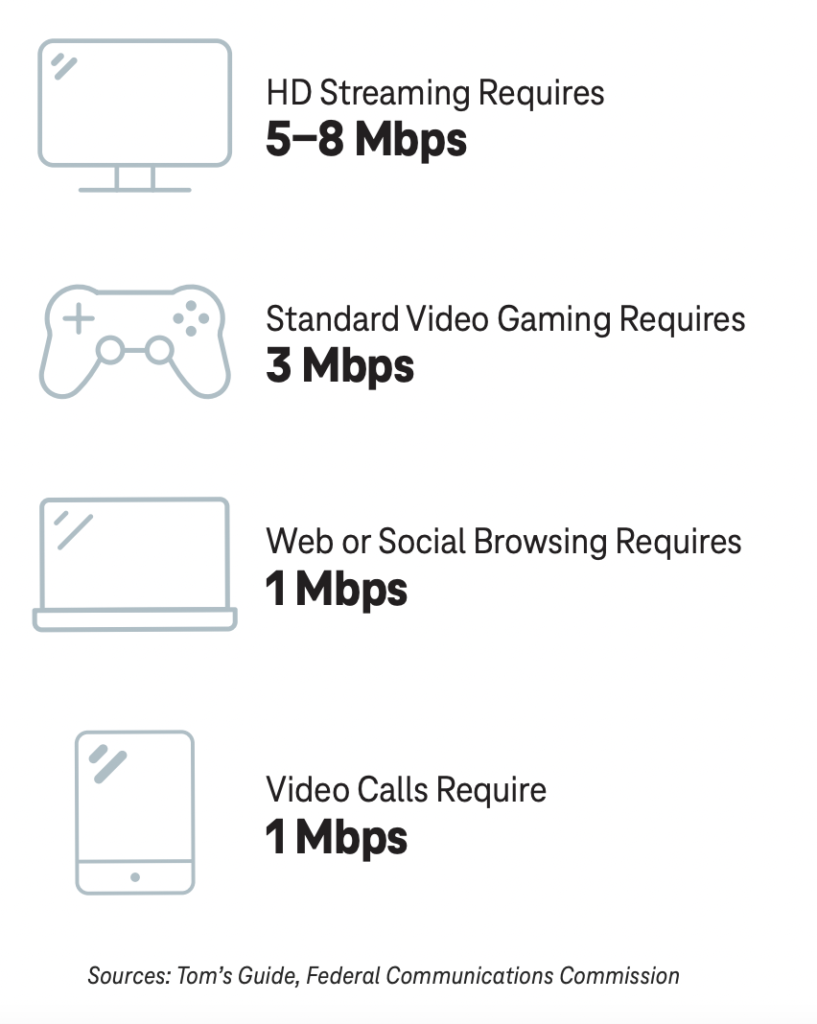

According to 2022 report from T-Mobile, the primary drivers behind users’ adoption of 5G Fixed Wireless Access (FWA) are surprisingly not just about speed. Many subscribers cited “lower prices” and “no annual contract obligation” as their main reasons for choosing FWA services. Notably, even though 5G is known for its high-speed capabilities, T-Mobile’s report strengthens that for many end users, network services don’t necessarily need ultra-high speeds. In fact, the FCC defines “broadband” as a minimum of 25 Mbps download and 3 Mbps upload speeds, and T-Mobile’s findings suggest that for a majority of households, a reliable 25 Mbps connection is sufficient for various activities, including HD streaming, gaming, social media browsing, and email, all at the same time.

The rural-urban disparity in Fixed Wireless Access (FWA) speed performance remains a notable challenge, as highlighted by a recent Ookla report. The report reveals that both T-Mobile and Verizon’s 5G FWA services exhibit slower speeds in rural areas compared to urban locations. This discrepancy can be attributed to variations in spectrum availability and the distance between rural areas and cell sites. Notably, Verizon’s FWA service report shows similar result with a median speed of 155.77 Mbps in urban areas during Q3 2023, while rural locations experienced only 51.41 Mbps.

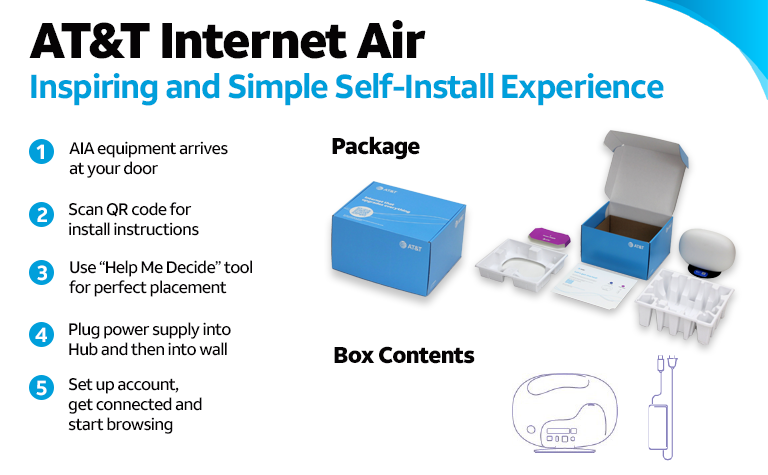

Meanwhile, AT&T’s Q2 2023 report showed a significant loss of 286,000 non-fiber subscribers, reducing their total to 5.95 million. Furthermore, AT&T also saw a drop of 25,000 DSL subscribers, leaving them with just 259,000. This illustrates the changing dynamics in the telecom industry, with T-Mobile’s FWA gaining ground while AT&T faces challenges in retaining non-fiber and DSL customers. In this reason, Late mover, AT&T finally introduced its Internet Air-branded 5G fixed wireless access (FWA) Internet service in April 2023. It rolled out FWA to existing copper-based customers with selecting locations with enough wireless coverage and capacity.

With the current revenue in Fixed Wireless Access (FWA) primarily stemming from new user acquisitions within the non-broadband or copper/cable segment, mainly driven by FWA’s affordability, the next five years present a challenge in identifying significant upselling opportunities. Some advanced movement for many major operators, such as AT&T with Internet Air, is on enhancing 5G FWA performance through additional C-band spectrum and potentially employing millimeter wave technology in T-Mobile’s 5G standalone network for FWA. Despite these technological advancements, the industry has yet to showcase a differentiated FWA premium service that demonstrates exceptional FWA performance. Moreover, many telecommunications companies still view FWA as a potential threat to cannibalize their existing Fixed Broadband (FBB) business, making it increasingly complex to find substantial upsell opportunities within the price-sensitive FWA user base.